capital gains tax increase 2021 uk

OTS proposals suggested bringing Capital Gains Tax in line with Income Tax currently charged at a basic rate of 20 percent and rising to 40 percent for higher rate taxpayers. Jun 21 2021 0.

U S Oil Output Slumps By Record One Third As Permian Freezes Occidental Oil Refinery Midland

The proposed capital gains tax reforms of which any Budget.

. The government has shelved proposals to raise capital gains tax but has agreed to make technical tweaks to simplify the process. This could result in a significant increase in CGT rates if this recommendation is implemented. Any amount above the basic tax rate will hit the 20 charge on assets and 28 for residential property.

In the current tax year people can take 12300 before they pay any capital gains free of tax. In a letter to the Officer of Tax Simplification conservative MP Lucy Frazer on behalf of the Treasury said. The Chancellor will announce the next Budget on 3 March 2021.

Theodore Lowe Ap 867-859 Sit Rd Azusa New York. Ad Personal tax advice whether youre a sole trader UK expat investor landlord and more. 2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019.

Proposed changes to Capital Gains Tax. Gains from selling other assets are charged at 10 for basic-rate taxpayers and 20 for higher-rate taxpayers. Income Tax and Capital Gains Tax.

UK government shelves proposals to increase Capital Gains Tax rate by. The annual exempt amount could be reduced from 12300 per annum to between 2000 and 4000 a dramatic. 0400 Sun Oct 24 2021.

Youll only need to pay these rates. 10 on assets 18 on property. Will capital gains tax increase at Budget 2021.

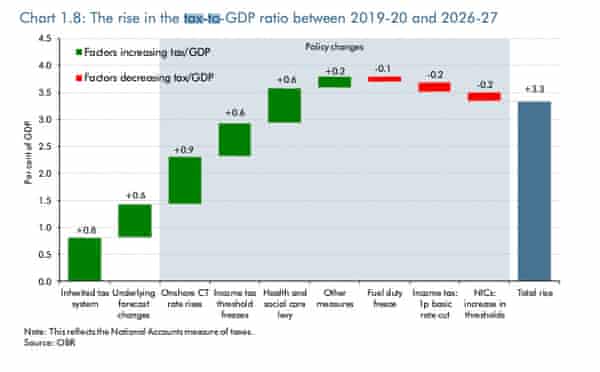

By Charlie Bradley 0700 Thu Oct 28 2021 UPDATED. Once again no change to CGT rates was announced which actually came as no surprise. Corporation tax and capital gains tax are central to the governments plan to help address the deficit that is on its way to 400bn 559bn this year.

You only have to pay capital gains tax on certain assets and do not have to pay it at all if your gains are under your tax free allowance which is 12300 or. Capital Gains Tax CGT has been one of the levies discussed. Fixing the public finances.

Implications for business owners. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015. Support for individuals and businesses through the Coronavirus pandemic.

In 2019-20 41 percent of capital gains tax came from those who made gains of 5million or more - a group which. Most capital gains tax comes from a small number of taxpayers who make large gains. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

The FCAs Consumer Duty regulation is gilding the lily Paradigm. The capital gains tax-free allowance for. Well pair you with a certified accountant who can chat through your questions and options.

Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. 20 on assets and property. CGT raises close to 10bn a year for the Treasury and last year the chancellor commissioned the Office of Tax Simplification OTS to look at how this tax could be reformed.

On Wednesday 4 March 2021 Chancellor Rishi Sunak presented his second Budget which he described as a three-part plan to protect the jobs and livelihoods of the British people comprising. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners to increase the extent to which these are subject to income tax. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

The changes in tax rates could be as follows. Rishi Sunak is once again considering an increase in capital gains tax to bring it into line with the higher levels of income tax rates in a. The OTS review of CGT published in November suggested four key changes as part of an overhaul.

CAPITAL GAINS TAX is likely to increase and there could be major implications for some Britons an expert has warned ahead of the Chancellor Rishi Sunaks Budget. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. Will capital gains tax increase at Budget 2021.

Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four. As announced at Budget the government will introduce legislation in Finance Bill 2021 that maintains the current Capital Gains Tax annual exempt amount at its present level of. The annual exempt amount could be reduced from 12300 per annum to between 2000 and 4000 a dramatic.

Capital gains tax rates for 2022-23 and 2021-22. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. Many speculate that he will increase the rates of capital gains tax to help raise cash necessary to recoup the public costs arising as a result of the COVID-19 pandemic.

The government will legislate in Finance Bill 2021-22 to extend the deadline for residents to report and pay Capital Gains Tax CGT payment after.

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

How Much Tax Will I Pay If I Flip A House New Silver

Rally Continues To Form The Canadian Technician In 2022 Value Investing Nasdaq Chart

British Consumers Started The Big Splurge Real Time Data Show In 2021 Online Jobs Job Website Job Posting

Capital Gains Tax What Is It When Do You Pay It

Optimizing Operational Experience To Influence Growth Optimization Business Performance Financial Advisory

Crypto Tax Uk Ultimate Guide 2022 Koinly

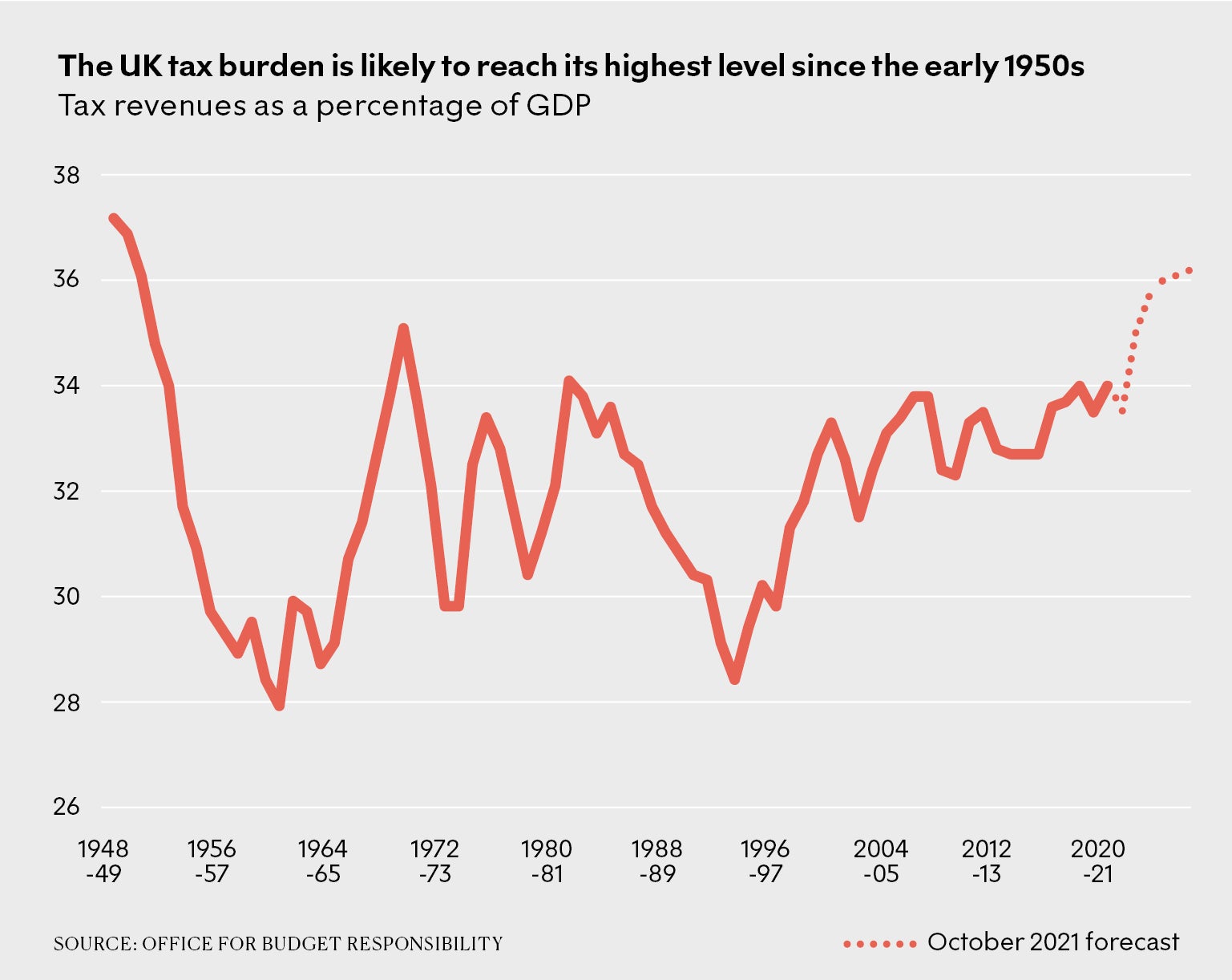

The Rise Of High Tax Britain New Statesman

U K Treasury Told To Avoid Tax Increases As Budget Deficit Growsby Alex Morales David Goodman And Andrew Atk Capital Gains Tax Government Debt The Borrowers

Https Thebla Co Uk Key Facts About Tax For Furnished Holiday Lettings Owners Landlords Landlord Prs Letting Being A Landlord Let It Be Capital Gains Tax

The Age Of Big Data Talent Development Development Education And Training

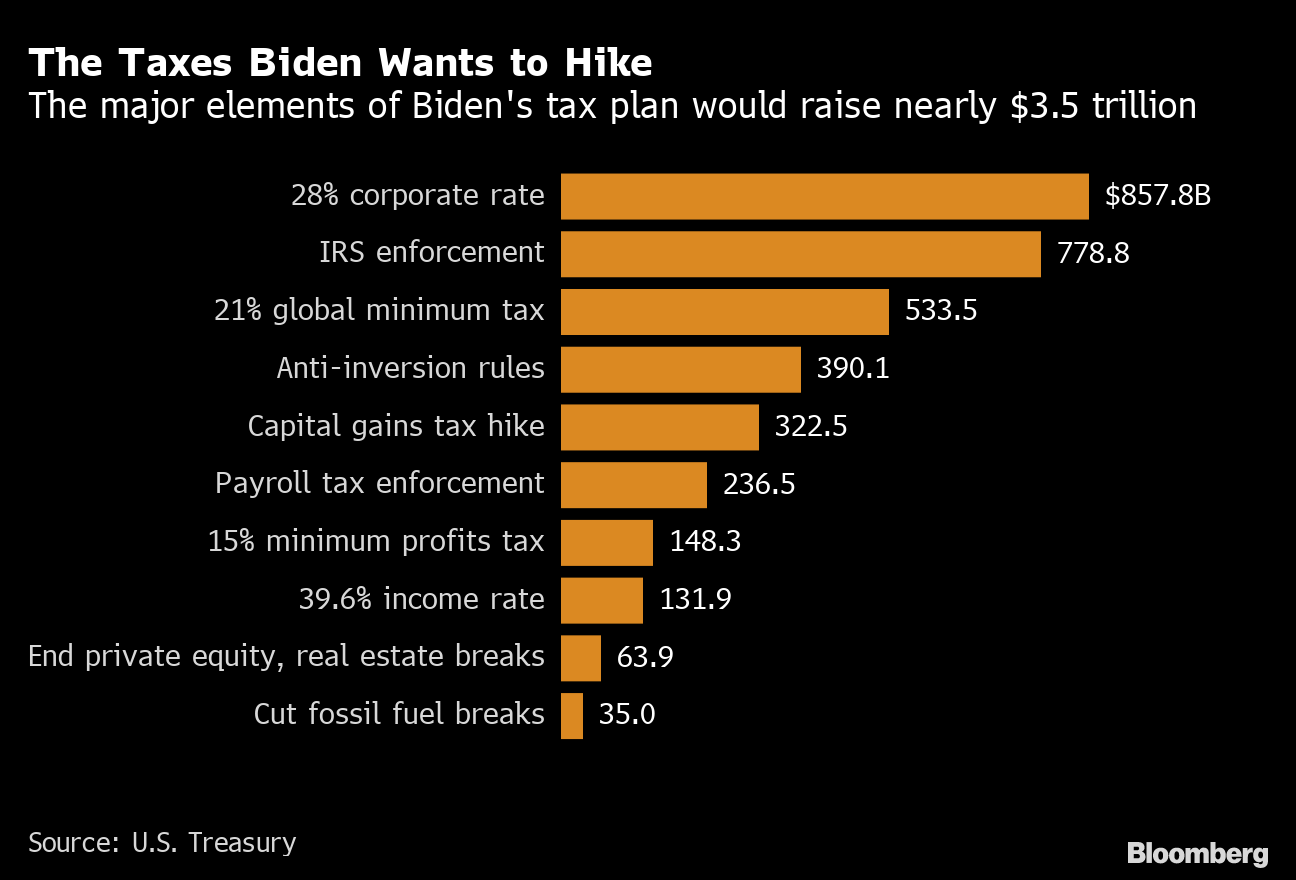

How Rich Americans Plan To Escape Biden Tax Hikes Ppli Is A Perfect Loophole Bloomberg

Can An Automatic Reload Script Have An Affect On Seo Seo Digital Marketing Healthcare Marketing Seo

If You Want To Be Successful In Ico Marketing You Must Have An Seo Friendly Website To Improve Site Ranking Promote Your Ico P Seo Ico Digital Marketing Plan

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)